Social Security Benefits Could Increase At Decades High Rate In 2023

Social Security Benefits Could Increase At Decades High Rate In 2023

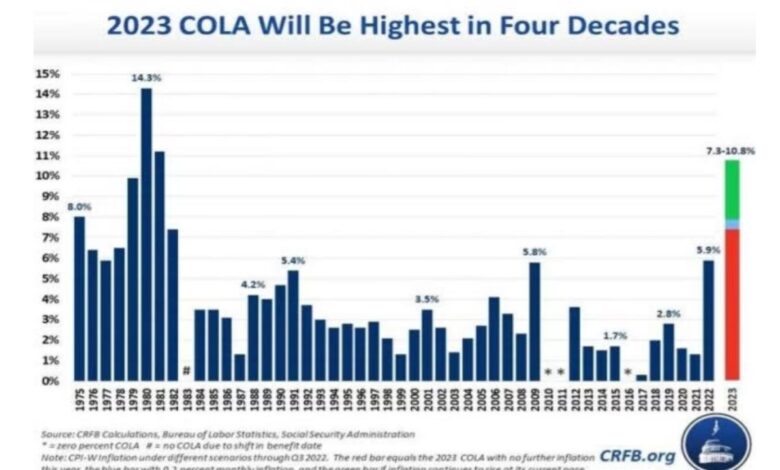

Despite a slight improvement in inflation in July, 2023 can see the highest growth in social security in decades, according to the senior citizens league’s latest forecast.

According to the bureau of labor statistics (BLS), the consumer price index (CPI), a measure of inflation, rose 8.5% annually in July. It was slightly below 9.1 percent in June, but it is close to the highest level of 40 years.

Since inflation levels remain high, the average cost of life for 2023 is predicted to be 9.6%, which is the highest level since 1981, according to the senior citizens league. If inflation increases further in the coming months, the cola might 10.1% in the next year. While if inflation kept slowing, it could be around 9.3%.

According to the group of elders, the current average retiring benefit will increase to $159 per month by $1,656.

If you are struggling financially, paying a loan with a personal loan can help reduce your interest rates and monthly payments.

2023 Social Security Increase Could Soon Be Decided

In the coming months, inflation behavior will create social security benefits for 2023. According to the senior citizens, only two months of consumer price data are left before the social security administration announced next year’s benefits in mid-october.

League Senior citizens league said, “a high cola will be eagerly expected to meet the ongoing reduction in benefits facing social security beneficiaries in 2022 as inflation exceeds their 5.9% of cola,” senior citizens league said.

The group said that this year’s benefits had reduced the consumer to an average of $58 per month in view of the recent levels of inflation.

If you are struggling with rising inflation, you can consider using personal loans to pay for a low-interest loan, which saves your money every month. Go to the credit to see multiple lenders together and choose one with the best interest rate for yourself.

More Seniors Receive Low-income Assistance

In a new survey of the senior citizens league, about 37% of participants reported receiving low income assistance in 2021. According to the us census, covid-19 is significantly higher than 16% of those receiving needs-based assistance before the epidemic.

“This suggests that epidemic disease and inflation have caused significantly higher Numbers of adults living on fixed income to turn to these programs to meet their social security and medical benefits as prices are constantly rising,” said group of elders.

But while the increase in cola means more benefits to social security recipients, it can also disqualify them from some low-income assistance. According to the survey, in 2022, when the social security check increased by 5.9%, nearly 14% of the elders saw a decline in their low-income assistance.

If you are struggling with inflation, paying a loan through personal loan can help you save monthly payments. Conconsciously to see if this is the right option for you.